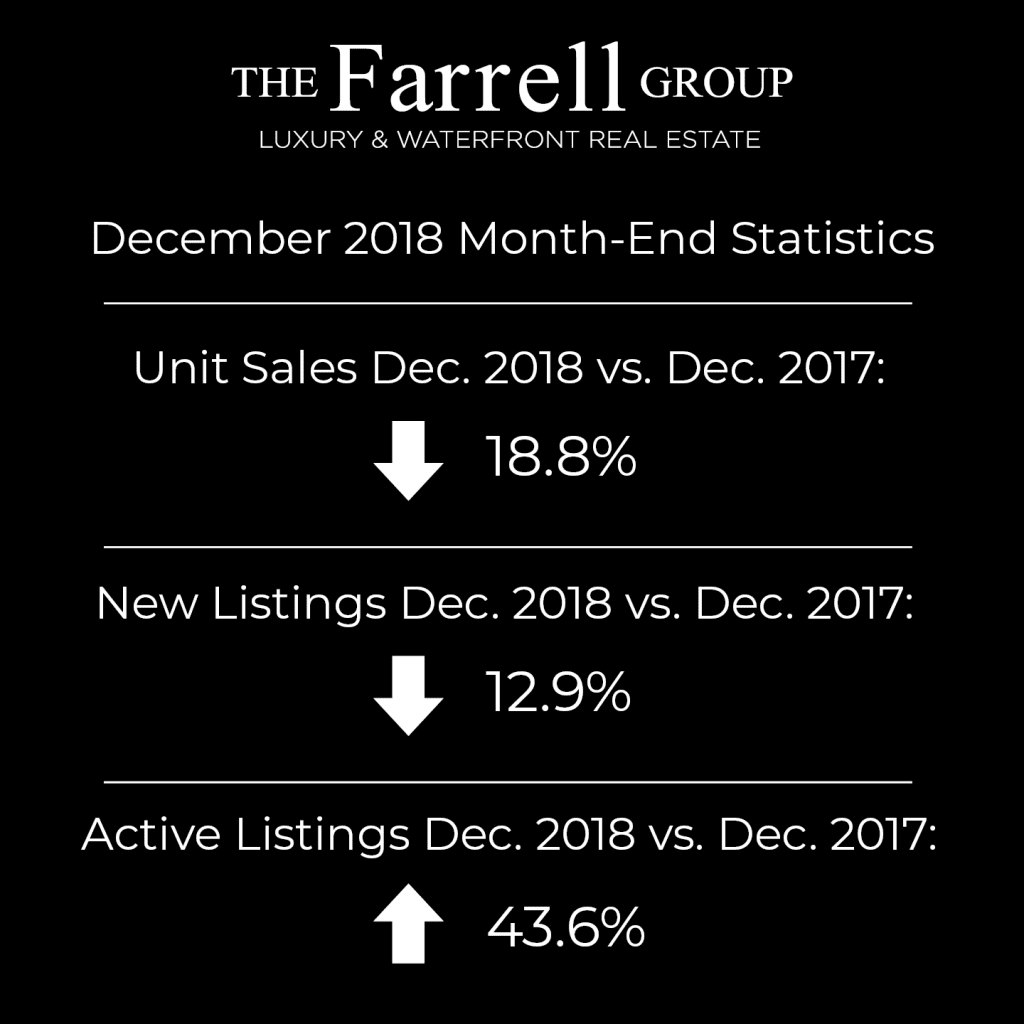

| Statistics

The month-end statistics (graphic below) for December were once again in line with expectations. Although unit sales and inventory were down and up, respectively, this represents more of a return to seasonal averages when compared to December 2017 when both sales and inventory were significantly skewed to a seller’s market as purchasers rushed to get purchases completed prior to the new mortgage B20 stress-test mortgage lending rules instituted by the Federal Government. Going forward into January we expect continued balanced market conditions as the market has now had the full year of 2018 to adjust to the new mortgage qualifying rules.

In addition to the market’s adaptation to the new mortgage rules, interest rates in Canada are in a state of flux – as recently as 4 weeks ago the Bank of Canada (BoC) stance on monetary policy was to continue to raise interest rates 3-5 more times in the next 18 months – since December 1st, various economic indicators, including employment, inflation and investment now have the BoC considering doing away with any interest rate increases in the near future – the BoC’s next interest rate decision announcement is scheduled for January 9. The outlook statement accompanying the rate decision will set the stage for the spring market.

The numbers and statistics never tell the entire story, especially in the extremely regional nature of real estate investments where even small differences in location, price range, size and many other factors can greatly affect the market and liquidity of any particular piece of property. For example, although active listings are up compared to December 2017, we are still seeing extremely low inventory levels for single family detached homes throughout Greater Victoria. Feel free to contact us to discuss your local market conditions that we share with all of our buyers and sellers considering transactions in the Victoria real estate market.